To top it all, consider 2.6%, 2.0%, 2.5%, 0.6% & 1.9% – a string of five quarters of below 3% growth, which has only happened 12 other times in the past 60 years. One can go on and on with statistics. But, the figures would appear to be even more disappointing considering the fact that all official indicators by the Federal Reserve, like employment, inflation et al run counter to the day to day experience of a common man! Take inflation for that matter, John Williams, an economist & specialist in government economic reporting calculates the Consumer Price Index (CPI) based on the pre- Clinton methodology and according to the methodology of the 1980s (no hedonic adjustments for quality improvements in manufactured goods & different weighting of the CPI basket of goods & services). According to him, adjusted to pre-Clinton Era methodologies, annual inflation was about 6.2%, in March and reset to the methodology of 1980, the SGS Alternate Consumer Inflation Measure rose to 10.2% in March (see chart to your right). US is perhaps already in recession, sans an honest admission by the Fed. But one must give them due credit for putting up a brave face, backed by a barrage of ‘cooked up’ statistics

– a string of five quarters of below 3% growth, which has only happened 12 other times in the past 60 years. One can go on and on with statistics. But, the figures would appear to be even more disappointing considering the fact that all official indicators by the Federal Reserve, like employment, inflation et al run counter to the day to day experience of a common man! Take inflation for that matter, John Williams, an economist & specialist in government economic reporting calculates the Consumer Price Index (CPI) based on the pre- Clinton methodology and according to the methodology of the 1980s (no hedonic adjustments for quality improvements in manufactured goods & different weighting of the CPI basket of goods & services). According to him, adjusted to pre-Clinton Era methodologies, annual inflation was about 6.2%, in March and reset to the methodology of 1980, the SGS Alternate Consumer Inflation Measure rose to 10.2% in March (see chart to your right). US is perhaps already in recession, sans an honest admission by the Fed. But one must give them due credit for putting up a brave face, backed by a barrage of ‘cooked up’ statistics

For Complete IIPM Article, Click on IIPM Article

– a string of five quarters of below 3% growth, which has only happened 12 other times in the past 60 years. One can go on and on with statistics. But, the figures would appear to be even more disappointing considering the fact that all official indicators by the Federal Reserve, like employment, inflation et al run counter to the day to day experience of a common man! Take inflation for that matter, John Williams, an economist & specialist in government economic reporting calculates the Consumer Price Index (CPI) based on the pre- Clinton methodology and according to the methodology of the 1980s (no hedonic adjustments for quality improvements in manufactured goods & different weighting of the CPI basket of goods & services). According to him, adjusted to pre-Clinton Era methodologies, annual inflation was about 6.2%, in March and reset to the methodology of 1980, the SGS Alternate Consumer Inflation Measure rose to 10.2% in March (see chart to your right). US is perhaps already in recession, sans an honest admission by the Fed. But one must give them due credit for putting up a brave face, backed by a barrage of ‘cooked up’ statistics

– a string of five quarters of below 3% growth, which has only happened 12 other times in the past 60 years. One can go on and on with statistics. But, the figures would appear to be even more disappointing considering the fact that all official indicators by the Federal Reserve, like employment, inflation et al run counter to the day to day experience of a common man! Take inflation for that matter, John Williams, an economist & specialist in government economic reporting calculates the Consumer Price Index (CPI) based on the pre- Clinton methodology and according to the methodology of the 1980s (no hedonic adjustments for quality improvements in manufactured goods & different weighting of the CPI basket of goods & services). According to him, adjusted to pre-Clinton Era methodologies, annual inflation was about 6.2%, in March and reset to the methodology of 1980, the SGS Alternate Consumer Inflation Measure rose to 10.2% in March (see chart to your right). US is perhaps already in recession, sans an honest admission by the Fed. But one must give them due credit for putting up a brave face, backed by a barrage of ‘cooked up’ statisticsFor Complete IIPM Article, Click on IIPM Article

Source : IIPM Editorial, 2007

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

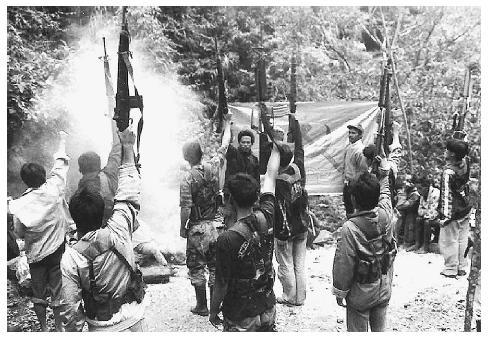

forgot about the billions our successive governments have had, and never invested on sincerely developing the situation of the underprivileged... Nevertheless, Naxalism today is nothing but an organised extortion racket at best, and a bloody terrorist organisation bereft of ideology at worst, oft en using the disguise of intellectualism to hide their real motive. So who takes the blame for this movement? Surprisingly, more than Naxalites themselves, the blame squarely lies on successive governments, who have never been able to provide productive employment, literacy, income, health services and a dignified existence to hundreds of millions of Indians. Think about it, after 60 years of so called ‘Independence’, India has 400 million poor. Naxalites have 400 million prospective members to recruit...

forgot about the billions our successive governments have had, and never invested on sincerely developing the situation of the underprivileged... Nevertheless, Naxalism today is nothing but an organised extortion racket at best, and a bloody terrorist organisation bereft of ideology at worst, oft en using the disguise of intellectualism to hide their real motive. So who takes the blame for this movement? Surprisingly, more than Naxalites themselves, the blame squarely lies on successive governments, who have never been able to provide productive employment, literacy, income, health services and a dignified existence to hundreds of millions of Indians. Think about it, after 60 years of so called ‘Independence’, India has 400 million poor. Naxalites have 400 million prospective members to recruit...

, as you know, I’ve done numerous actions with PETA to help get the word out. I traded in my red Baywatch swimsuit for a lettuce-leaf bikini for an ad promoting vegetarianism. I’ve narrated exposés of the leather trade in India and the meat industry in the US. Earlier this year, I spearheaded a petition drive against the annual seal hunt in Canada, where baby seals are still beaten bloody on the ice for their fur. I’ve fi red off letters, posed for posters, called on designers to create animal-friendly fashions, and even written an opinion piece for The Wall Street Journal, urging advertising executives to stop using unwilling animal actors to sell products. Everyone can do their part – whether it’s something as bold as attending a demonstration or as simple as making a vegetarian meal for a loved one. Every little bit helps – the important thing is to just do something.

, as you know, I’ve done numerous actions with PETA to help get the word out. I traded in my red Baywatch swimsuit for a lettuce-leaf bikini for an ad promoting vegetarianism. I’ve narrated exposés of the leather trade in India and the meat industry in the US. Earlier this year, I spearheaded a petition drive against the annual seal hunt in Canada, where baby seals are still beaten bloody on the ice for their fur. I’ve fi red off letters, posed for posters, called on designers to create animal-friendly fashions, and even written an opinion piece for The Wall Street Journal, urging advertising executives to stop using unwilling animal actors to sell products. Everyone can do their part – whether it’s something as bold as attending a demonstration or as simple as making a vegetarian meal for a loved one. Every little bit helps – the important thing is to just do something.

seems to be threatened by a creeping tendency to be ‘soft ’ with negotiators and potential antagonists. There is the nuclear deal with the United States, where Uncle Sam is steadily moving the goalposts and trying to stifle and choke India’s strategic ambitions. There is Australia that claims that it will not supply Uranium to India even if there is a nuclear deal with Uncle Sam, because India violates international nuclear weapons control regimes. There is Pakistan that continues to mollycoddle terrorists while claiming that terror camps have been shut down. Most signifycantly, there is China which brazenly announces that Arunanchal Pradesh is an integral part of the Middle Kingdom, and hence refuses to give visas to people from the state.

seems to be threatened by a creeping tendency to be ‘soft ’ with negotiators and potential antagonists. There is the nuclear deal with the United States, where Uncle Sam is steadily moving the goalposts and trying to stifle and choke India’s strategic ambitions. There is Australia that claims that it will not supply Uranium to India even if there is a nuclear deal with Uncle Sam, because India violates international nuclear weapons control regimes. There is Pakistan that continues to mollycoddle terrorists while claiming that terror camps have been shut down. Most signifycantly, there is China which brazenly announces that Arunanchal Pradesh is an integral part of the Middle Kingdom, and hence refuses to give visas to people from the state. he most persistent – and valid – charges against the Indian state by strategic analysts, over the years, has been that it’s a ‘soft state’. According to them, India has borrowed generously from Mahatma Gandhi and transformed foreign policy into the art of turning the other cheek whenever there has been a diplomatic slap. The more adventurous and bellicose of these analysts want India to learn from Israel when it comes to an uncompromising and relentless pursuit of ‘national interests’. These pundits would have Indian troops chasing terrorists across the border into Pakistan Occupied Kashmir. Fortunately for India, that kind of jingoism has not replaced hard headed pragmatic diplomacy of the type practised over the last two decades. Along with the spectacular rise in the size and status of the Indian economy since 1991, pragmatic diplomacy, too, has earned many brownie points in the global arena.

he most persistent – and valid – charges against the Indian state by strategic analysts, over the years, has been that it’s a ‘soft state’. According to them, India has borrowed generously from Mahatma Gandhi and transformed foreign policy into the art of turning the other cheek whenever there has been a diplomatic slap. The more adventurous and bellicose of these analysts want India to learn from Israel when it comes to an uncompromising and relentless pursuit of ‘national interests’. These pundits would have Indian troops chasing terrorists across the border into Pakistan Occupied Kashmir. Fortunately for India, that kind of jingoism has not replaced hard headed pragmatic diplomacy of the type practised over the last two decades. Along with the spectacular rise in the size and status of the Indian economy since 1991, pragmatic diplomacy, too, has earned many brownie points in the global arena.

Himalayan neighbouring countries, India and China, continues to grow at the same pace then not much time is left until when bilateral trade between the countries would touch the $40 billion mark. Analysts believe that the India – China bilateral trade is all set to rise from the current $25 billion to $40 billion by 2009, thus the target would be achieved by one year in advance. In Q1 2007, trade registered a growth of 58% and has touched $8.2 billion. It is being forecasted that bilateral trade between the countries would build up to $43 billion by 2010.

Himalayan neighbouring countries, India and China, continues to grow at the same pace then not much time is left until when bilateral trade between the countries would touch the $40 billion mark. Analysts believe that the India – China bilateral trade is all set to rise from the current $25 billion to $40 billion by 2009, thus the target would be achieved by one year in advance. In Q1 2007, trade registered a growth of 58% and has touched $8.2 billion. It is being forecasted that bilateral trade between the countries would build up to $43 billion by 2010.